An offer is a collective term for fees charged by a Money Manager for his services. Whether you are an Investor or a Money Manager, it is important to understand the fees and the difference between them.

Performance Fee

This fee is charged depending on the percentage of profit return the Money Manager is capable of generating from their trades. This section may be tiered accordingly, with the price varying through percentages. This may only be charged in percentage.

Let’s say we have $500 in the pool of funds. If the Manager makes 30% profit ($150), the Investor would be charged a 12% fee. Any profit greater than 30% ($150+) will cost the investor 15%.

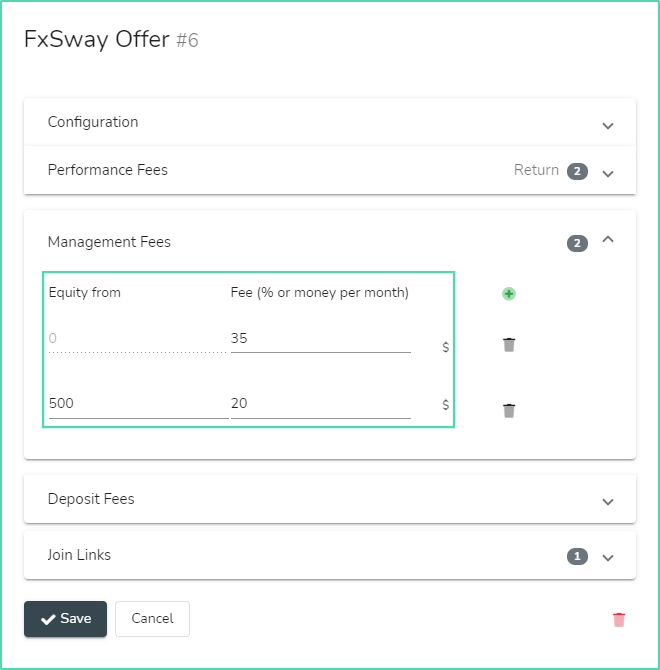

Management Fee

This fee is charged for managing the Investor’s money and depends on the equity (amount) they invest.

In the example, if the Investor deposits up to $500, a $35 fee will be charged, whereas deposits from $500 onwards require a $20 fee.

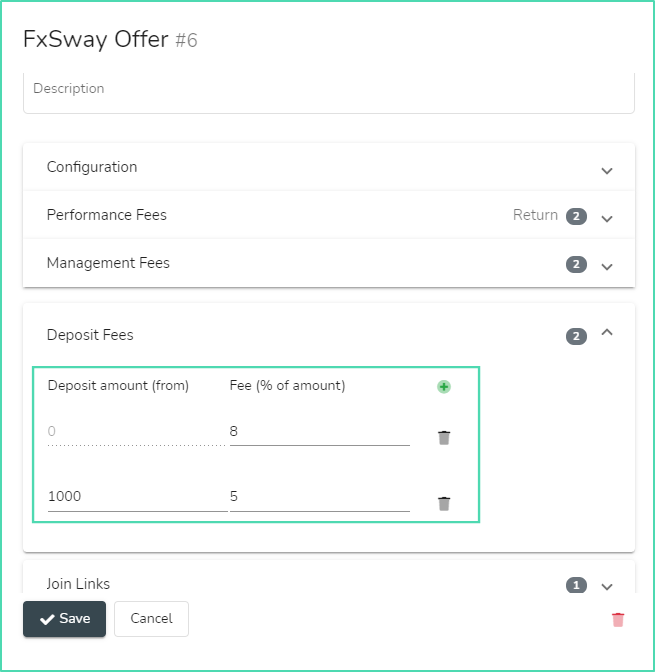

Deposit Fee

This fee is charged each time a deposit is made into the fund, including the first deposit.

If you deposit up to $1000, a 8% fee is charged, whereas deposits from $1000 onwards will require a 5% fee.

Log In

Log In  Sign Up

Sign Up